Mitom TV – Xem trực tiếp bóng đá miễn phí hôm nay MitomTV

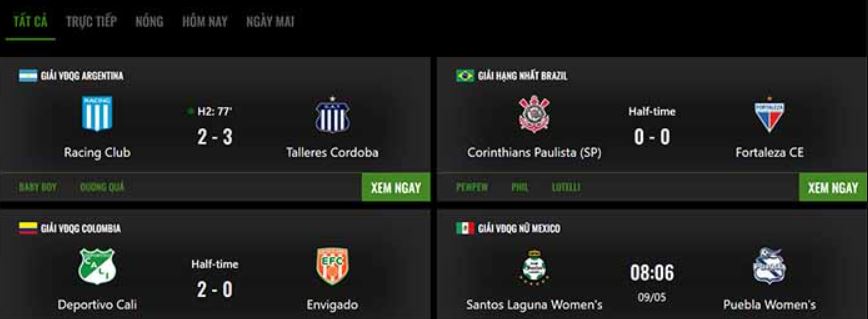

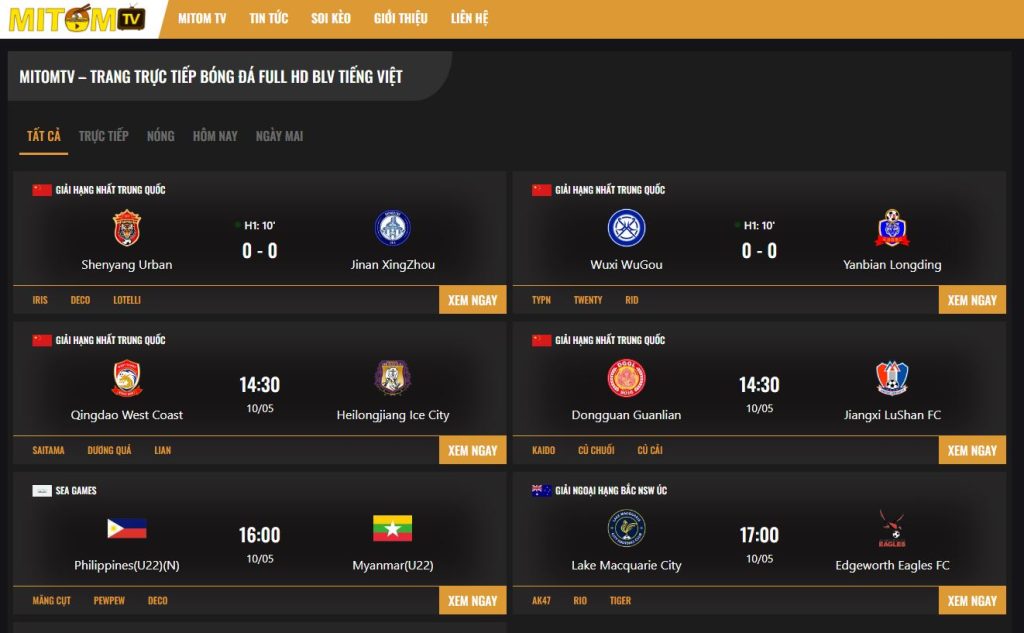

- Tất cả (64)

- Trực tiếp (1)

- Nóng (3)

- Hôm nay (14)

- Ngày mai (50)

KUDO

KUDO  MONSTER

MONSTER  BACAR

BACAR  A PHẠCH

A PHẠCH

TẠ BIÊN GIỚI

TẠ BIÊN GIỚI  CÁ

CÁ  FANTA

FANTA  DECO

DECO  SINGER

SINGER  RICKHANTER

RICKHANTER

SINGER

SINGER  DECO

DECO  CÁ

CÁ  RICKHANTER

RICKHANTER  FANTA

FANTA  TẠ BIÊN GIỚI

TẠ BIÊN GIỚI

Bin Bin

Bin Bin  LOGAN

LOGAN  CÔNG LÝ

CÔNG LÝ  Thạch Tú

Thạch Tú  SÙNG A MÚP

SÙNG A MÚP  KEVILL

KEVILL

SHOGUN

SHOGUN  SAO LA

SAO LA  MESSI

MESSI  MĂNG CỤT

MĂNG CỤT

LOGAN

LOGAN  TOMMY

TOMMY  Củ Cải

Củ Cải  PIRLO

PIRLO  TYPN

TYPN  LONG

LONG

NAM TÀO

NAM TÀO  TAP

TAP  ENZO

ENZO

ZUKA

ZUKA  EDWARD

EDWARD

LUFFY

LUFFY

TAM MAO

TAM MAO  Bin Bin

Bin Bin  SÙNG A MÚP

SÙNG A MÚP  CRIS

CRIS  CÔNG LÝ

CÔNG LÝ  PEWPEW

PEWPEW

CAPTAIN

CAPTAIN  BẬP BÙNG

BẬP BÙNG

NIBO

NIBO  ĐỐM

ĐỐM

VI TIỂU BẢO

VI TIỂU BẢO  GÔN

GÔN

Mitom02.tv là trang chuyên trực tiếp bóng đá chất lượng Full HD, là domain chính thức của thương hiệu Mitom. Không chỉ theo dõi những trận cầu đặc sắc anh em còn được tham khảo nhiều tin tức thể thao hấp dẫn cùng tỷ lệ soi kèo chuẩn xác.

Bằng cách này, bạn sẽ sớm đưa ra được quyết định chuẩn xác. Không những thế, khách chơi còn tránh mất tiền oan khi cá cược. Cùng khám phá thêm những phân tích hữu ích bên dưới để biết đâu là nơi đáng chọn bạn nhé!

MITOM TV

| 🥇 Mitom Trực Tiếp Bóng Đá |

⭐️ Mitomtv Nhận Định Trận Đấu Trước Trận |

| 🥇 Kênh MitomTv Chính Thức | ⭐️ Cập Nhật Kết Quả Bóng Đá |

| 🥇 Bản Quyền Trận Đấu Đến Từ MitomTV | ⭐️ Liên Tục Cập Nhật Kết Quả |

| 🥇 Mitom Kênh Phát Sóng Bóng Đá Hàng Đầu | ⭐️ Đưa Ra Tỷ Lệ Kèo Tốt Nhất Cho Người Chơi |

Mitom TV là website cung cấp link xem trực tiếp bóng đá chất lượng cao, miễn phí tất các giải đấu lớn nhỏ trên khắp thế giới với giàn BLV chuyên nghiệp hàng đầu hiện nay. Địa chỉ cung cấp những trận bóng tại Việt Nam nói riêng, trên thế giới nói chung với chất lượng Full HD. Nhờ thế, bạn có thể theo dõi được trận cầu yêu thích của mình mọi lúc mọi nơi.

Chắc chắn anh em sẽ không thất vọng khi xem bóng đá tại Mitom TV. Điện web còn là điểm dừng chân quen thuộc của anh em đam mê trái cầu. Nơi đây cung cấp tỷ lệ kèo, lịch thi đấu, bảng xếp hạng cũng như tin tức quanh trận bóng với quy mô quốc gia, khu vực cho đến quốc tế.

Nói tóm lại, Mitom TV không chỉ giúp bạn xem trực tiếp bóng đá mà còn tìm thấy nhiều thông tin hay, hữu ích cho quá trình chơi cược. Cụ thể:

Xem trực tiếp bóng đá full HD tại Mitomtv

Mitom TV là web tường thuật bóng đá Việt Nam áp dụng công nghệ 4.0 trong phát sóng trực tiếp. Hơn nữa, địa chỉ còn liên kết với nhiều kênh trực tiếp uy tín. Vậy nên, mỗi lần theo dõi các trận cầu tại đây anh em đều cảm nhận được sự chân thực từ âm thanh cho tới hình ảnh. Cụ thể:

Chất lượng hình ảnh: Mọi trận cầu đều được có độ phân giải Full HD giúp fan hâm mộ có thể bắt trọn từng pha phá lưới cũng như đường bóng lăn.

Âm thanh: Âm thanh mỗi trận cầu đều mô tả sống động, chân thực nhất. Dù theo dõi qua màn ảnh nhỏ thế nhưng anh em vẫn cảm nhận được không khí cuồng nhiệt, sống động như đang đứng trực tiếp ở khán đài.

Có thể nói Mì Tôm TV còn là nơi giúp anh em giải tỏa sự căng thẳng, stress. Đồng thời, qua đó bạn sẽ tái tạo năng lượng để dai sức hơn với cuộc sống cũng như công việc của mình.

Lịch thi đấu cập nhật mới nhất

Hơn nữa, khi tới đây fan hâm mộ trái bóng còn sớm tiếp cận hàng loạt những trận cầu đỉnh cao quy mô từ nhỏ cho tới lớn. Khi biết lịch thi đấu từ sớm bạn sẽ sắp xếp được thời gian, chủ động lên kế hoạch xem bóng đá.

Nhờ vậy, anh em sẽ tránh làm ảnh hưởng tới sức khỏe cũng như công việc của mình. Vì thế, còn đợi gì nữa mà không truy cập web này ngay hôm nay để cập nhật nhiều thông tin giá trị hơn.

Bảng xếp hạng

Tại đây anh em sẽ xem được chi tiết bảng xếp hạng của bất kỳ giải bóng đá nào mình muốn. Qua đó bạn sẽ biết thành tích cũng như thực lực của đội bóng mình yêu thích.

Bảng xếp hạng thiết kế tổng quản giúp fan hâm mộ đánh giá khách quan về tình hình trận cầu. Nhờ đó, bạn sẽ biết cách chơi cược thông minh hơn.

Kết quả bóng đá chuẩn xác

Mitom TV cũng cập nhật cả kết quả của toàn bộ các trận cầu vừa mới diễn ra. Qua đó bạn sẽ biết chính xác tỷ số trận đấu mình không theo dõi trực tiếp được.

Không những vậy, kết quả này cũng cho bạn thêm dữ liệu hay để có hướng đi đúng đắn cho lần cá cược tiếp theo.

Tỷ lệ kèo

Không những vậy trang trực tiếp bóng đá này còn tổng hợp cả tỷ lệ kèo của mọi trận cầu trên toàn thế giới.

Tại đây anh em sẽ xem được bảng kèo chi tiết của những trận bóng sắp diễn ra với thông tin chuẩn. Bằng cách này chúng ta có thể soi kèo bất kỳ trận bóng nào mình muốn một cách dễ dàng hơn.

Tin tức bóng đá

Đặc biệt không chỉ tận hưởng những trận đấu đang diễn ra, bạn còn được đọc những tin tức bóng đá cập nhật hàng giờ, hàng ngày trên web.

Mitom TV luôn nỗ lực cập nhật sớm nhất về các thông tin như giải đấu, lịch sử thi đấu, phong cách đội bóng, phong độ thi đấu, nhận định bóng đá, thậm chí là thông tin bên lề cùng nhiều nội dung khác…

Ngoài ra, MitomTV còn có nhiều tính năng hữu ích khiến nhiều người cảm thấy hài lòng. Vậy nên bạn còn đợi gì nữa, hãy nhấn chuột vào web Mitom T V để trải nghiệm ngay hôm nay!

MITOMTV CÓ GÌ ĐẶC BIỆT?

Nhiều người băn khoăn không biết lý do gì khiến Mitom TV lại có nhiều lượt truy cập đến vậy? Bạn cũng nằm trong số đó, vậy đọc ngay đánh giá khách quan sau để biết đâu là kênh trực tiếp bóng đá chất lượng, đáng chọn hơn nữa:

MitomTV ra đời khi nào?

Mitom TV chính thức thành lập ngày 19/11/2021. Với nỗ lực không ngừng của những chuyên gia bóng đá hàng đầu cùng thành viên trong Mì Tôm TV, địa chỉ này ngày càng đổi mới, hoàn thiện hơn và được cộng đồng fan hâm mộ bóng đá đón nhận, yêu thích.

Cuối tháng 1 năm 2022, web đã đàm phán và mua thành công 2 nhà bình luận bóng đá lớn tại Việt Nam đó là Xoilac và 90phut. Hơn nữa, trang trực tiếp này đã đăng cai tổ chức những giải bóng đá độc quyền khu vực miền Trung – Nam.

Những giải đấu này đã nhận được sự ủng hộ của đại đa số người hâm mộ thể thao. Sau thành công này web đã tiếp tục đăng cai tổ chức những giải đấu quy mô, chuyên nghiệp hơn ở khu vực Tây Nam Bộ đưa MitomTV trở thành một trong web trực tiếp bóng đá lớn nhất nhì Việt Nam hiện nay.

Tầm nhìn của Mitom TV

Mitom TV đang nỗ lực từng ngày để trở thành kênh trực tiếp bóng đá uy tín hàng đầu Việt Nam. Đây chính là bước đệm giúp web kết nối rộng khắp khu vực cũng như trên toàn thế giới.

Với đội ngũ chuyên gia bóng đá cùng chiến lược bài bản, Mì Tôm TV tin rằng sẽ sớm thực hiện được tầm nhìn đáng hướng đến.

Sứ mệnh của Mitom TV

Sứ mệnh của Mitom TV là đem tới cho người hâm mộ đường link trực tiếp bóng đá chất lượng. Bất cứ ai dù ở trong hay ngoài nước đều xem được các trận cầu với chất lượng cao mà không tốn chi phí nào.

Ở Mi Tom TV có vô vàn trận bóng đỉnh cao cùng đội ngũ bình luận viên chuyên nghiệp để anh em thưởng thức trọn vẹn bóng đá nhất. Bên cạnh đó, các thông tin về bóng đá cũng được chuyên trang chăm chút mỗi ngày. Vì thế hãy sớm đến với hệ thống để có nhiều trải nghiệm bóng đá giá trị hơn.

Mục đích Mitom TV đang hướng đến

Là trang trực tiếp bóng đá trong và ngoài nước, để có thành công là nhờ vào tầm nhìn và mục đích rõ ràng của người tạo kênh. Cụ thể:

- Mang tới cho người hâm mộ thể thao vua kênh truyền tải thông tin chất lượng, uy tín và cập nhật thường xuyên.

- Cho anh em website phát sóng trực tuyến bóng đá miễn phí 100%.

- Mitomtv là tạo group dành riêng fan đam mê cá cược bóng đá hoạt động. Đây chính là nơi trao đổi thông tin, kinh nghiệm cá cược cũng như sở thích chung của họ…

- Tạo kênh xem bóng đá trực tuyến chất lượng, giúp anh em được sống đúng với đam mê bóng đá mà không sợ bị tác động bởi yếu tố khách quan. Chuyên trang luôn đem tới cho người xem trận đấu mượt mà, không giật lag.

- Mục đích cuối cùng đó chính là tạo không gian xem bóng đá online an toàn nhất. Ngày nay có không ít web lợi dụng niềm tin người hâm mộ để ăn cắp thông tin với mục đích trục lợi. Nhưng khi tới với Mi Tom TV bạn có thể yên tâm hoàn toàn về độ bảo mật tại đây.

Hy vọng với chia sẻ này đã giúp bạn nhận ra được Mi Tom TV có điểm gì đặc biệt. Hãy sớm đến với web để có thêm khám phá thú vị hơn nữa.

REVIEW CHI TIẾT VỀ MITOMTV

MitomTV có tốt không? Kênh này uy tín không? Tại sao nhiều người đồng hành với web này đến vậy? mì tôm với xoilac.tv 90 phut có phải là một hay không?

Đây chính là băn khoăn của không ít người hâm mộ trái bóng. Những Review chi tiết bên dưới sẽ giúp bạn giải đáp được câu hỏi trên và có nhận định đúng đắn nhất:

Giao diện bắt mắt

Trước khi xây dựng web, đội ngũ phát triển đã khảo sát hành vi người dùng để thiết kế trang có diện dễ sử dụng. Bất cứ ai dù không biết nhiều về công nghệ đều có thể dùng được.

Thêm vào đó, tone màu trắng đen hài hòa khiến người xem có cảm giác tinh tế, nhẹ nhàng. Không những vậy tone này còn làm nổi bật những chức năng quan trọng để bạn tìm thông tin mình cần nhanh nhất. Đặc biệt anh em sẽ không cảm thấy đau mắt khi nhìn vào màn hình quá lâu.

Mặt khác bố cục được thiết kế khoa học, chia ra nhiều mục như trực tiếp trận đấu hôm nay, ngày mai, trận cầu nóng… giúp bạn dễ tìm trận bóng mình yêu thích.

So với nhiều kênh trực tiếp bóng đá, MitomTV được đánh giá rất cao về giao diện đẹp mắt. Hệ thống giúp người chơi có trải nghiệm hài lòng ngay từ phút giây đầu tiên.

Nội dung đa chiều

Đến với Mi Tom TV đồng nghĩa việc fan hâm mộ thể thao vua được tiếp cận với thế giới bóng đá tru nhỏ.

Ngoài xem trực tiếp các trận cầu hấp dẫn, kênh còn cập nhật nội dung đa chiều, có một không hai gồm:

- Anh em sớm biết chính xác lịch thi đấu của những giải bóng diễn ra mỗi ngày.

- Qua những góc nhìn đa chiều qua mục tin tức giúp bạn sớm tiếp cận cầu thủ mình yêu thích.

- Những nhận định khách quan tới từ nhiều chuyên gia bóng đá giúp chúng ta có thêm được dữ liệu hay, chuẩn để biết đâu là đội bóng sẽ đem tới vận may cho mình đấy.

- Kênh giúp chúng ta hiểu về tình hình trận đấu cũng như thực lực từng đội bóng. Từ đó, bạn sẽ có thêm dữ liệu hay để biết đâu mới là cửa cược chuẩn. Bằng cách này nhiều người đã thắng đậm và tránh quyết định sai lầm.

- Hơn nữa Mitom TV còn giúp bạn tiếp cận với kiến thức từ cơ bản cho tới chuyên sâu về thể thao vua. Từ đó anh em sẽ có kế hoạch đánh cược thông minh.

- Mặt khác tại đây còn chia sẻ tips hay để anh em nâng cao kỹ năng cá cược.

Chính vì vậy bạn còn đợi gì mà chưa ghé website trực tiếp bóng đá để có trải nghiệm hài lòng hơn. Bằng cách đó bạn sẽ tái tạo năng lượng tích cực hơn nữa đấy. Tin rằng, đây là nơi giúp anh em thu hút vận may và sớm phất lên sau vài lần chơi cược.

Tốc độ nhanh

Đội ngũ phát triển của Mitom TV đã và đang không ngừng cố gắng đem lại cho anh em trải nghiệm tuyệt vời không thua kém việc xem trực tiếp tại truyền hình.

Tức là, đến với MitomTV bạn sẽ không phải chờ đợi lâu nhờ công nghệ hiện đại cùng Server xuyên suốt ở trạng thái tốt. Nhờ đó, tốc độ tải của hệ thống ở mức đáng nể chỉ 0.02s/click. Như vậy khi trải nghiệm bóng đá tại đây anh em sẽ không bao giờ bị chậm nhịp.

Đặc biệt, MitomTV còn liên tục cập nhật những link xem bóng đá trực tiếp trước trận đấu từ 1 tiếng cho tới 3 tiếng.

Có thể thấy, tốc độ nhanh đã giúp việc trải nghiệm của fan hâm mộ thêm chất lượng hơn. Vậy nên, đây chính là điểm đến giải tỏa áp lực trong cuộc sống, công việc của nhiều người.

Bình luận viên chuyên nghiệp

Đội ngũ bình luận viên là nhân tố quan trọng đem tới cho người chơi trải nghiệm bóng đá chân thực nhất. Họ sẽ đồng hành cùng người chơi xuyên suốt giờ lăn bóng.

Mỗi câu bình luận của họ đều đem tới những thông tin giá trị, thú vị. Không những vậy BLV còn góp phần khuấy động bầu không khí gay cấn, căng thẳng trong mỗi trận tranh tài.

Với khả năng dùng ngôn từ linh hoạt, đội ngũ bình luận viên tại đây đã thu hút hàng trăm, ngàn lượt đăng ký. Sự đồng lòng cũng như quyết tâm của họ đã biến trận bóng nhàm chán trở nên cuốn hút hơn trong mắt người hâm mộ cho tới phút giây cuối cùng.

Hơn nữa, những pha ghi bóng, lượt phạt góc hay số lần thẻ vàng, đỏ… được các BLV chia sẻ bằng tiếng Việt còn đem tới cho bạn bạn thông tin cá cược giá trị nữa đấy!

Bảo mật tuyệt đối

Chưa dừng ở đó, Mi Tom TV còn bảo mật tuyệt đối bằng 3 lớp hiện đại với công nghệ Secure Sockets Layer. Điều này đồng nghĩa với việc anh em tránh được nguy cơ bị đánh cắp dữ liệu cá nhân.

SSL chính là công nghệ bảo mật ưu việt nhất hiện nay. Hơn nữa, MitomTV còn đảm bảo nói không với việc mua bán thông tin cá nhân của người xem dưới mọi hình thức. Chính vì thế, bạn có thể tan tâm xem bóng đá, tham gia cá cược khi đến với chọn lựa này.

Quảng cáo ít

Điểm cộng lớn khi xem trực tiếp bóng đá tại Mi Tom TV đó chính là ít chèn quảng cáo trong suốt quá trình trận cầu diễn ra. Bởi lẽ mục tiêu phát triển của web này ngay từ khi dưng kênh là đem tới cho người hâm mộ trải nghiệm tốt nhất.

Thế nhưng, do là kênh miễn phí 100% vậy nên MitomTV vẫn nhận chèn banner, quảng cáo tại giao diện chính. Tuy nhiên nếu anh em cảm thấy thông tin quảng cáo banner gây phiền toái và không hữu ích hoàn toàn có thể tắt bất cứ khi nào.

Khả năng tương thích cao

Đặc biệt, Mitom TV còn cho phép anh em xem bóng đá, tiếp cận với thông tin bằng nhiều cách khác nhau. Chúng ta chỉ cần sở hữu thiết bị điện tử với hệ điều hành từ IOS, Android đến Window Phone… kết nối mạng Internet là dễ dàng theo dõi trận cầu và cập nhật nhiều thông tin giá trị tại https://veneur.org/.

Nói cách đơn giản hơn, bạn chỉ cần có máy tính, điện thoại, Macbook hay laptop, thậm chí TV thông minh là đã có thể dễ dàng tới với kênh này.

Hỗ trợ tận tâm 24/7

Mặt khác, trang trực tiếp bóng đá này còn hỗ trợ nhiệt tình cho fan hâm mộ trái cầu khi gặp vấn đề phát sinh. Hệ thống luôn để cao tiêu chí trong việc tuyển chọn đội ngũ nhân viên tư vấn.

Vậy nên những người này đều am hiểu chuyên sâu về bóng đá cũng như lĩnh vực cá cược. Điều này đồng nghĩa việc, vấn để của bạn sẽ sớm được giải quyết.

Mặt khác, sự nhanh chóng, kịp thời mà hệ thống đem tới sẽ không làm anh em thất vọng. Vậy nên, sớm đến với Mi Tom TV để có thêm trải nghiệm hài lòng hơn.

Chính những ưu việt kể trên đã khiến Mitom TV trở thành điểm đến được nhiều người hâm mộ bóng đá yêu thích. Đến nay hệ thống vẫn có hàng trăm thành viên tham gia mỗi ngày, con số này vẫn tăng và chưa có dấu hiệu suy giảm.

MITOM TV TRỰC TIẾP NHỮNG TRẬN ĐẤU NÀO?

Theo đánh giá của fan hâm mộ, MitomTV đang là trang trực tiếp đầy đủ các giải bóng đá trong và ngoài nước.

Tại đây, anh em có thể tìm và theo dõi bất kỳ giải đấu nào trên toàn thế giới. Cụ thể, những giải bóng hàng đầu được Mi Tom TV trực tiếp gồm:

Ngoại Hạng Anh

Ngoại Hạng Anh là giải đấu hàng đầu của Anh có tất cả 20 đội cùng tranh tài giành chức vô địch. Giải cầu này tổ chức hàng năm từ tháng 8, kết thúc tháng 5 năm sau.

Cho đến nay, giải bóng này chỉ có 6 CLB thay nhau đăng quang đó là Liverpool, Manchester United, Chelsea và Leicester City, Arsenal, Blackburn Rovers. Đồng thời Ngoại Hạng Anh còn là nơi thăng hoa của những siêu sao bóng đá như Cristiano Ronaldo, Alan Shearer, Thierry Henry, Ryan Giggs, David Beckham và nhiều tên tuổi khác.

Những trận cầu trong giải này thu hút quan tâm của đông đảo fan hâm mộ trên khắp cả nước. Vậy anh em còn đợi gì nữa, hãy truy cập Mitom ngay hôm nay để theo dõi các trận bóng Ngoại Hạng Anh hấp dẫn với chất lượng Full HD.

World Cup

World Cup là giải đấu được tổ chức 4 năm một lần và là nơi hội tụ anh tài hàng đầu thế giới. Có thể nói cúp vàng thế giới chính là mơ ước của mọi cầu thủ chuyên nghiệp.

Mitom TV là một trong các web phát sóng trực tiếp 64 trận cầu quyết liệt trong mọi khuôn khổ World Cup. Tại đây anh em sẽ được theo dõi những trận bóng sôi động, hấp dẫn của 32 đội tuyển tới từ các châu lục khác nhau.

Đặc biệt dù chưa tới ngày trực tiếp nhưng hệ thống chuẩn bị đầy đủ yếu tố nhằm sẵn sàng phát sóng trận bóng đỉnh cao. Vì thế bạn chỉ cần truy cập địa chỉ này là có thể theo dõi được bất cứ trận nào dù là ở vòng bảng hay tứ kết, bán kết hoặc chung kết.

Euro

Euro là giải bóng được tổ chức bởi Liên đoàn bóng đá Châu Âu FIFA nhằm tạo sân chơi cọ xát giữa đội tuyển quốc gia thuộc Châu Âu.

Có thể nói, Euro là một trong các sự kiện đang được người hâm mộ mong đợi nhất trên toàn cầu. Đồng thời giải bóng này cũng góp phần không nhỏ trong lịch sử bóng đá ngày nay.

MitomTV hiện cũng đang trực tiếp vòng loại Euro 2024 miễn phí với đường truyền mạnh, tốc độ nhanh cùng chất lượng chuẩn HD. Vậy bạn còn đợi gì nữa để theo dõi những trận đấu vòng loại của Euro, truy cập web ngay thôi nào!

Serie A

Serie A chính là giải đấu chuyên nghiệp của Ý được Telecom Italia tài trợ trực tiếp. Nhà vô địch trong giải bóng sẽ nhận danh hiệu Scudetto cao quý cùng cup Coppa Campioni d’Italia.

Tính tới thời điểm hiện nay, Serie A đã qua hơn 90 năm phát triển và đóng góp không nhỏ trong quá trình tạo lịch sử túc cầu toàn thế giới với nhiều trận bóng ấn tượng, đỉnh cao.

Serie A được đánh giá là giải bóng được nhiều người quan tâm nhất đối với các thành viên tại Bsport. Sức hút của nó tới từ cầu thủ tài năng cùng pha bóng đầy tính chiến thuật.

MitomTV hiện đang trực tiếp mọi giải bóng Serie A với chất lượng HD. Hãy truy cập để có thêm trải nghiệm hấp dẫn bạn nhé!

La Liga

La Liga là giải cầu lớn nhất của Tây Ban Nha với tên gọi Campeonato Nacional de Liga de Primera División. Giải bóng đá chuyên nghiệp Vương quốc Anh đã trực tiếp điều hành giải đấu này.

Trong mùa giải, La Liga có sự góp mặt của 20 đội bóng, trong đó 3 đội thứ hạng thấp nhất phải xuống hạng. Từ khi thành lập cho tới nay giải bóng đó tất cả 62 đội tham gia.

Tới thời điểm hiện nay, La Liga đã được nâng cấp rõ rệt về quy mô. Không chỉ ở chất lượng của những đội bóng mà cả cơ sở vật chất cũng như lượng khán giả.

Chính vì vậy không ít anh em đến với MitomTV chỉ để theo dõi trận cầu này. Những trận đấu tại đây đều có chất lượng Full HD với tốc độ nhanh cùng bình luận tiếng Việt sôi động khiến fan hâm mộ khó lòng rời mắt khỏi màn hình.

Bundesliga

Bundesliga – giải bóng vô địch quốc gia Đức, đây chính là hạng thi đấu cao nhất trong bóng đá Đức. Giải bóng hiện đang thu hút lượng lớn khán giả trên toàn thế giới.

Hoạt động của Bundesliga theo thể thức xuống hạng và thăng hạng. Mùa giải thường kéo dài trong khoảng thời gian từ tháng 8 cho tới tháng 5 năm sau và diễn ra cuối tuần. Tuy nhiên, một số trận được tổ chức trong ngày bình thường.

Mitom TV hiện đang cung cấp đường link chính và dự phòng theo dõi tất cả các giải cầu Bundesliga với chất lượng Full HD cùng tốc độ nhanh.

Ligue 1

Ligue 1 có thể nói là giải vô địch cao cấp nhất của Pháp. Giải bóng ra đời năm 1932, hiện vẫn đang phát triển mạnh và được nhiều người yêu thích.

Trận cầu này được Ligue de Football Professionnel điều hành trực tiếp với sự tham gia của 20 CLB và cũng hoạt động với hệ thống thăng hạng, xuống hạng và tới Ligue 2.

Trong mùa giải 2021 – 2022 Paris Saint-Germain chính là đội bóng giành được giải vô địch. CLB nước ngoài AS Monaco nhiều lần vô địch đã khiến giải Ligue 1 trở thành một giải bóng xuyên biên giới.

Các giải bóng tại đây đem tới cho toàn bộ fan hâm mộ cảm xúc từ hồi hộp cho tới tốc độ. Hệ thống Mì Tôm TV chắc chắn sẽ tiếp sóng và bình luận tất cả trận cầu đình này khi giải đấu diễn ra.

V-League

V League là giải vô địch quốc gia Việt Nam hiện đang thu hút lượng lớn khán giả cả trong và ngoài nước bởi cầu thủ nổi tiếng và tính chất quyết liệt. Không những vậy, fan hâm mộ trái cầu Việt theo dõi trận bóng tại League tại Mitom TV còn vì niềm tự hào địa phương.

Ngoài ra, MitomTV còn trực tiếp nhiều giải bóng khác như: Aff Cup , U23 Châu Á, Copa América, Sea Games…

HƯỚNG DẪN CÁCH XEM BÓNG ĐÁ TẠI MITOMTV

Anh em có thể dễ dàng theo dõi những trận cầu yêu thích ngay tại Mi Tom TV chỉ với 3 thao tác đơn giản:

- Bước 1: Chuẩn bị thiết bị thông minh như điện thoại, PC, Laptop… kết nối Internet ổn định.

- Bước 2: Truy cập https://veneur.org/

- Bước 3: Tìm trận bóng đang quan tâm ngay tại trang chủ -> click trận đấu -> xem ngay.

Chỉ với 3 thao tác bạn đã có thể theo dõi trận bóng yêu thích vậy còn đợi gì nữa, nhanh tay thực hiện ngay thôi nào!

Tóm lại Mì Tôm TV là kênh trực tiếp bóng đá chất lượng Full HD đáng dừng chân dài lâu. Fan hâm mộ trái cầu nên sớm tiếp cận hệ thống để có nhiều trải nghiệm cuồng nhiệt ngay trên sân bóng và gợi ý cá cược hay đến từ các nhà cái uy tín.

#MiTom #MìTôm #MìTômTV #MiTomTV